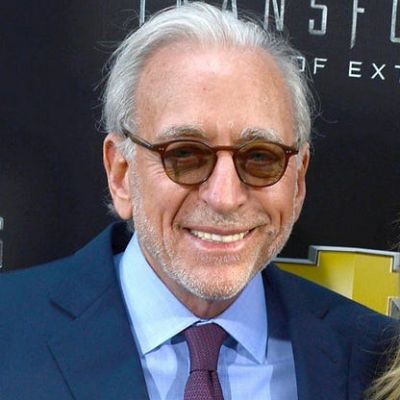

The newest step in the Nelson Peltz and Disney proxy battle is that Peltz’s Trian Fund Management has decided to end the conflict. Notably, this occurred just after Disney announced a new reorganization plan that includes many job losses and cost-cutting measures. The Disney proxy conflict started in January 2023, when Nelson Peltz’s Trian Fund Management pressured Disney to grant him a seat on the board. The business said that it formerly possessed 9.4 million shares worth around $900 million, however, this was accumulated a few months before to the proxy war.

When Disney began to disagree with Peltz’s fund management, the fight escalated. Nelson Peltz, though, has put a stop to the fight with Disney’s current reorganization plans.

Nelson Peltz, speaking on CNBC, said,

“The proxy war has ended.”

On February 11, 2023, Disney issued a statement. The business said in the statement that they are delighted that its Board of Directors and management can stay focused without the distraction of a proxy battle.

The statement went on to say:

“We have enormous trust in Bob Iger’s leadership and the revolutionary vision he laid out for Disney’s future yesterday.”

It is worth mentioning that Bob Iger is the current CEO of Disney, having succeeded his predecessor Bob Chapek in November 2022 after the former was sacked. Iger was the company’s CEO from 2005 until his contract terminated in 2020.

Net Worth

Nelson Peltz is a wealthy investor, businessman, and founding partner of Trian Fund Management. He also serves on the boards of numerous notable firms. Peltz’s net worth is estimated to be approximately $1.4 billion by Forbes. Peltz was raised in Brooklyn and started working for his family at a young age. His family had a food company, which he eventually expanded into a multi-million dollar firm.

Nelson Peltz serves on the boards of many corporations.

Peltz and his partners later launched Trian Fund Management in 2005. They invested in brands and businesses like as Heinz, Wendy’s, and Kraft via this firm. According to sources, Peltz holds more than 278,275 shares in Wendy’s Co valued at more than $570,506,794. According to Forbes, Trian Fund Management manages $8.5 billion in assets.

Disney’s reorganization plan will include cost cutbacks as well as 7,000 layoffs.

Disney unveiled the massive restructuring plan and said that they would be aiming to minimize costs, which are projected to be approximately $5.5 billion. Aside from that, they will lay off around 7,000 people. According to reports, the corporation intends to reorganize its operations into three sections and will concentrate on making its streaming business profitable by 2024. The annual shareholder meeting of Disney is set on April 3, 2023.

Activist investor Nelson Peltz on CNBC right now: Everyone made money, the proxy fight is over…. “I didn’t realize it’s his (Bob Iger) birthday, maybe I’ll send him a gift”. $DIS +4.9%

— Kristina Partsinevelos (@KristinaParts) February 9, 2023